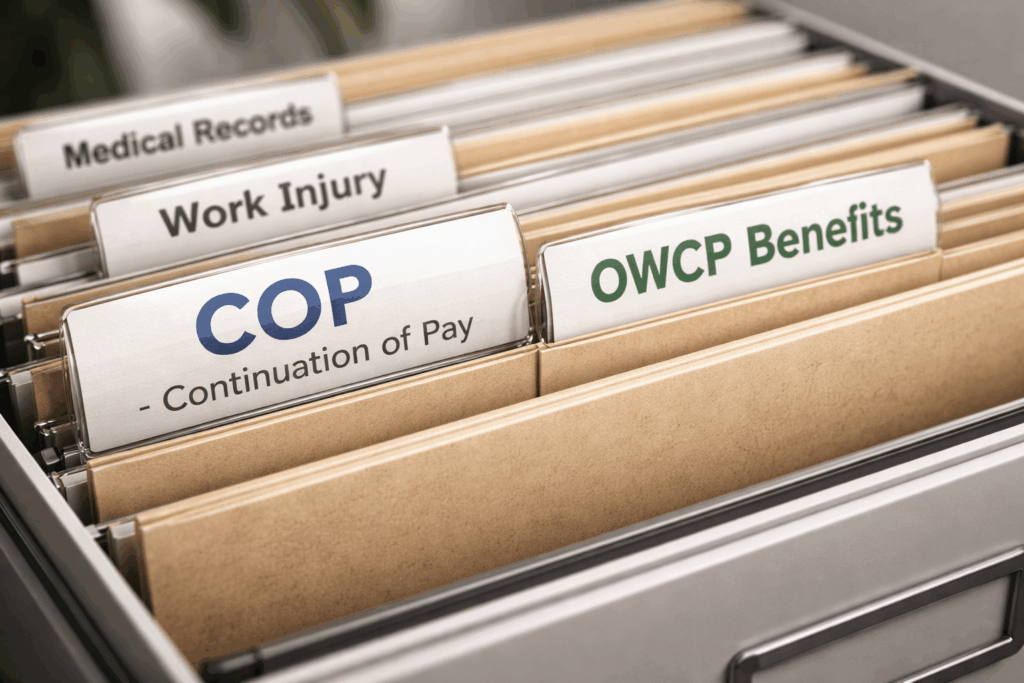

When a USPS employee is injured on the job, income protection quickly becomes a major concern. Many employees hear terms like “COP” and “OWCP” used interchangeably, which can lead to confusion and unrealistic expectations about pay, timelines, and long-term support.

While both Continuation of Pay (COP) and Office of Workers’ Compensation Programs (OWCP) benefits are part of the federal workers’ compensation system, they are not the same. They serve different purposes, follow different rules, and apply at different stages of an injury-related absence.

This article explains the difference between USPS Continuation of Pay and OWCP benefits in clear, practical terms—so you know what each one does, how they work together, and where income gaps can occur.

Why understanding the difference matters

Injury-related absences often come with uncertainty. Medical recovery timelines are unclear, paperwork can be complex, and pay may change suddenly. Knowing how COP and OWCP differ helps USPS employees:

- Anticipate when pay may change

- Avoid surprises after COP ends

- Plan for periods of reduced income

- Understand why additional income protection may be needed

Neither COP nor OWCP guarantees uninterrupted full pay, and neither should be viewed as a long-term income solution on its own.

What is Continuation of Pay (COP)?

Continuation of Pay (COP) is a short-term wage continuation benefit available to USPS employees who experience a qualifying traumatic injury at work.

What COP is designed to do

COP allows eligible employees to continue receiving their regular paycheck while they recover from a job-related traumatic injury. It is meant to prevent immediate income disruption right after the injury occurs.

Key characteristics of COP

- Pays regular wages, not partial benefits

- Covers up to 45 calendar days

- Applies only to traumatic injuries (not occupational illnesses)

- Does not use sick or annual leave during the COP period

- Requires timely reporting and medical documentation

COP is not a separate insurance program—it is an extension of regular USPS pay during a very limited timeframe.

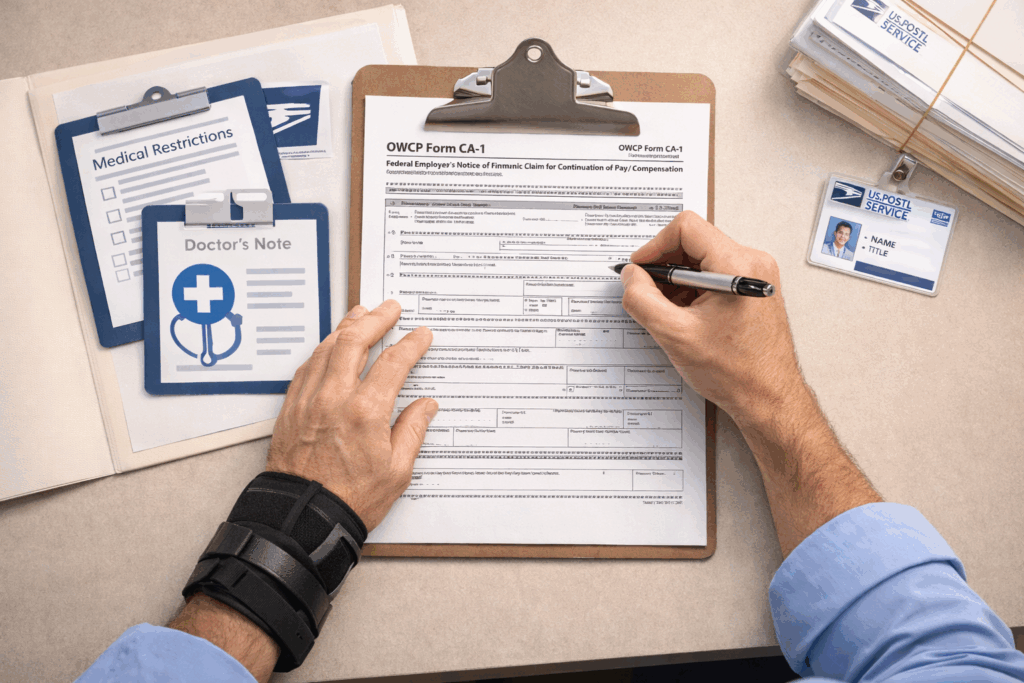

What qualifies as a traumatic injury?

A traumatic injury is defined as a sudden, identifiable injury caused by a specific event or incident during a single work shift.

Examples may include:

- Slips, trips, or falls

- Lifting injuries from a specific incident

- Being struck by an object

- Vehicle-related accidents while working

Traumatic injuries are reported using Form CA-1 (Federal Employee’s Notice of Traumatic Injury and Claim for Continuation of Pay/Compensation).

What is OWCP?

OWCP stands for the Office of Workers’ Compensation Programs, a division of the U.S. Department of Labor that administers workers’ compensation benefits for federal employees, including USPS workers.

OWCP benefits apply after COP ends or when COP does not apply.

What OWCP provides

OWCP may provide:

- Wage-loss compensation (partial income replacement)

- Medical coverage for approved conditions

- Schedule awards for permanent impairment (in some cases)

- Vocational rehabilitation support (when applicable)

Unlike COP, OWCP benefits are not automatic and require claim approval.

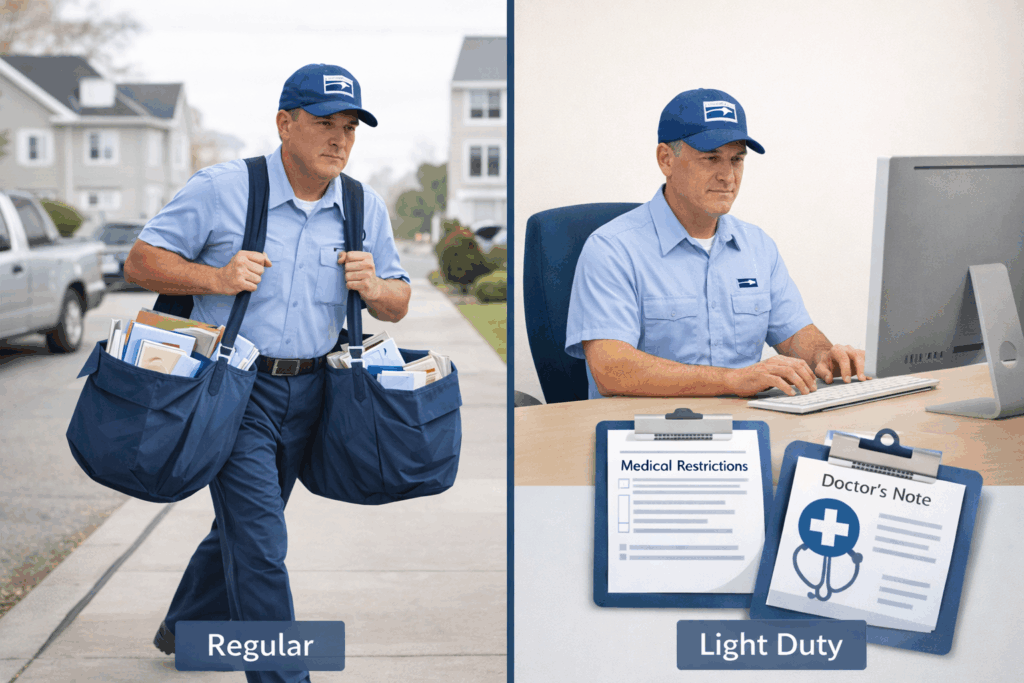

Occupational illness vs traumatic injury

A critical difference between COP and OWCP is the type of condition involved.

Occupational illness

Occupational illnesses develop over time due to work conditions rather than a single event. Examples include:

- Repetitive stress injuries

- Worsening joint or back conditions

- Exposure-related illnesses

These conditions are filed using Form CA-2 (Notice of Occupational Disease) and are not eligible for COP. Income during the early stages often comes from sick leave, annual leave, or LWOP (Leave Without Pay) while OWCP reviews the claim.

Timeline comparison: COP vs OWCP

Understanding timing helps explain why income disruptions are common.

COP timeline

- Begins shortly after a qualifying traumatic injury

- Lasts up to 45 calendar days

- Ends regardless of recovery status

OWCP timeline

- Begins only after claim approval

- May start after COP ends or immediately for CA-2 claims

- Often involves processing delays

This gap between COP ending and OWCP approval is one of the most financially stressful periods for injured USPS employees.

How pay differs between COP and OWCP

COP pay level

- Paid at 100% of regular wages

- Includes normal USPS paycheck structure

- Feels like “business as usual” financially

OWCP wage-loss compensation

OWCP wage-loss benefits are typically:

- About 66⅔% of wages if you have no dependents

- About 75% of wages if you have eligible dependents

- Tax-free in many cases

While tax-free status can help, the reduction in gross income often requires adjustments to household budgets.

Medical documentation requirements

Both COP and OWCP require medical support, but expectations increase significantly once OWCP is involved.

COP documentation

- Initial medical evidence supporting work-related injury

- Certification of disability for the COP period

OWCP documentation

- Detailed medical narratives

- Clear causal relationship between work and condition

- Ongoing updates and treatment plans

Incomplete or unclear medical documentation is a common reason for OWCP delays or denials.

Common misconceptions USPS employees have

“COP lasts as long as I’m injured”

COP ends after 45 calendar days, even if you are still unable to work.

“OWCP replaces my full paycheck”

OWCP provides partial wage replacement, not full salary.

“COP applies to all work-related injuries”

COP applies only to traumatic injuries filed on Form CA-1—not occupational illnesses.

“Once OWCP starts, income issues are solved”

OWCP benefits may still be lower than regular pay and may take time to process.

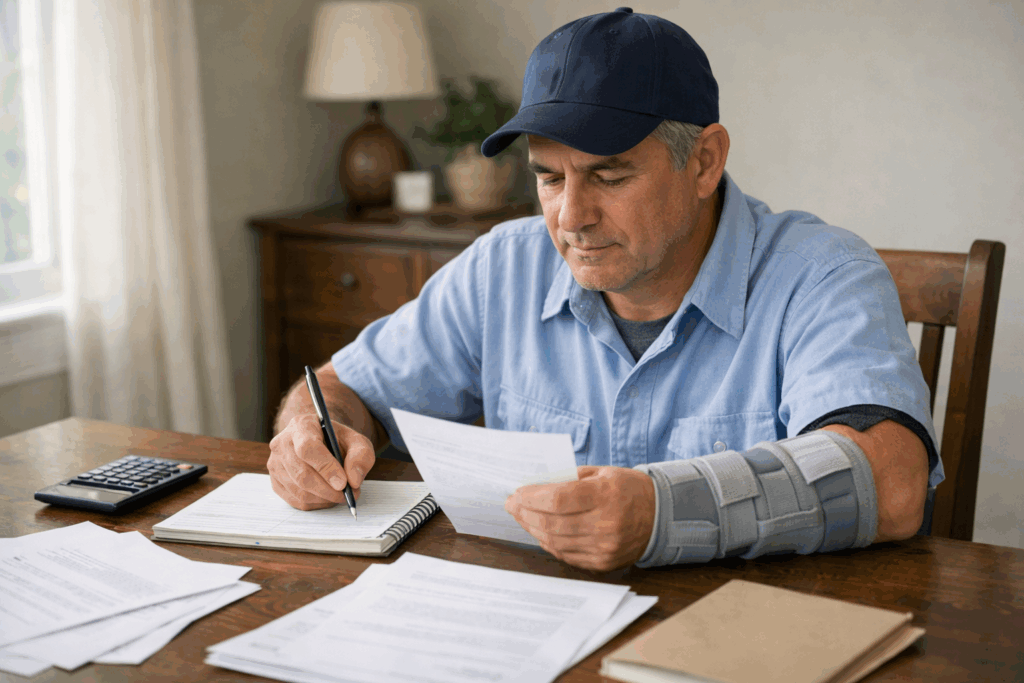

Where income gaps often occur

Income gaps frequently happen when:

- COP ends before OWCP wage-loss benefits begin

- OWCP claim approval is delayed

- Partial benefits do not cover full expenses

- Leave balances are exhausted

This is why many USPS employees find that relying only on COP and OWCP can leave them financially exposed during longer recoveries.

Planning beyond COP and OWCP

COP and OWCP are important parts of the federal injury system, but they were not designed to provide long-term income stability on their own.

Planning considerations include:

- Understanding how long COP will last

- Preparing for reduced income under OWCP

- Knowing how leave, LWOP, and benefits interact

- Reviewing additional disability income protection options

Educational resources from Postal Life and Disability Plans help USPS employees understand how different income sources coordinate during injury-related absences and recovery periods.

You may also find it helpful to review PLDP’s guidance on disability income protection for postal employees, which explains how non-OWCP disability coverage can help address income gaps.

Final perspective on COP and OWCP differences

Continuation of Pay and OWCP benefits serve different roles in the injury recovery process. COP provides short-term wage continuation for traumatic injuries, while OWCP offers longer-term—but partial—income replacement once claims are approved.

Understanding where one ends and the other begins can reduce uncertainty and help USPS employees prepare financially during recovery.

If you’re dealing with injury-related income loss as a USPS employee, understanding your disability income protection options can help protect your finances during recovery. Learning how COP, OWCP, and disability coverage work together can provide clarity and peace of mind during a difficult time.