When you’re injured or become ill while working for the United States Postal Service, returning to work isn’t always a straightforward process. Many employees find themselves offered light duty or limited duty assignments as they recover. While these modified work arrangements can help you stay employed and maintain income, they also create important questions about your disability benefits and workers’ compensation claims.

Understanding how light duty and limited duty assignments interact with your Federal Employees’ Compensation Act (FECA) benefits, Office of Workers’ Compensation Programs (OWCP) claims, and private disability insurance is essential for making informed decisions during your recovery.

What Light Duty and Limited Duty Mean at USPS

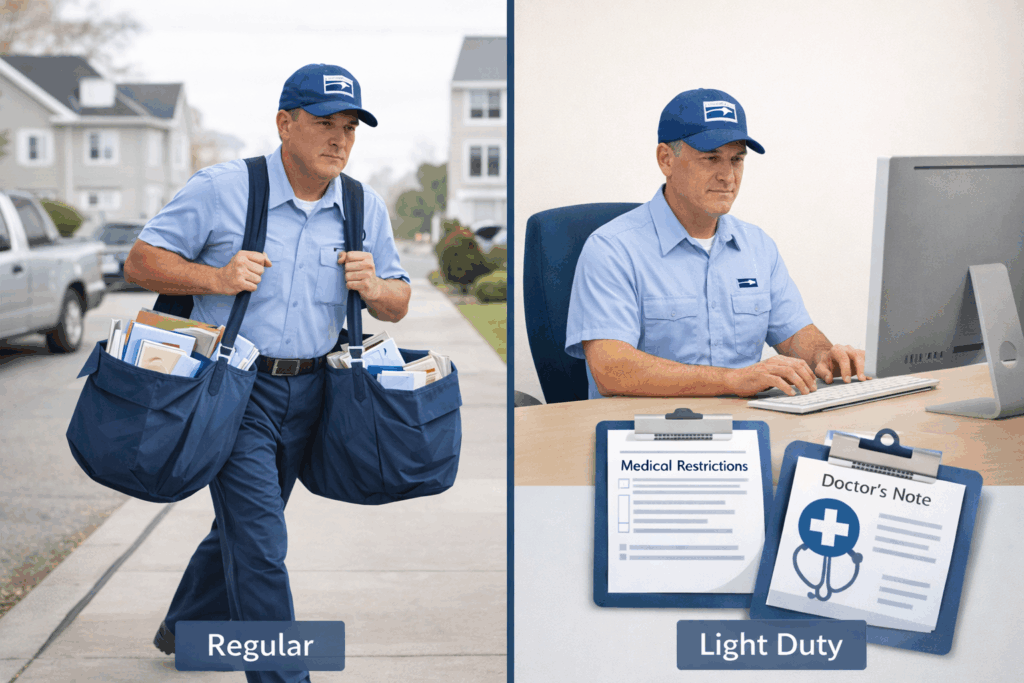

Light duty and limited duty are terms used somewhat interchangeably within the Postal Service, though they technically describe modified work arrangements that accommodate medical restrictions. When your doctor provides work restrictions due to injury or illness, USPS may offer you a position that fits within those limitations.

These assignments typically involve tasks that require less physical exertion, different movements, or reduced hours compared to your regular position. For example, a letter carrier with a back injury might be assigned to office work that involves sorting mail while seated rather than walking a delivery route.

The key distinction to understand is that light duty positions are temporary accommodations, usually lasting no more than 90 days, while limited duty assignments can extend longer when your medical condition requires ongoing restrictions but allows you to perform some work functions.

How Light Duty Affects OWCP Benefits

If you’ve filed a workers’ compensation claim with OWCP after a work-related injury or occupational illness, accepting light duty has significant implications for your compensation benefits.

When OWCP approves your claim, you may receive compensation for lost wages if you cannot work or can only work reduced hours. This compensation typically equals two-thirds of your regular salary if you have no dependents, or three-quarters if you have at least one dependent.

However, once USPS offers you a light duty position that falls within your medical restrictions and you refuse it without valid medical justification, OWCP may reduce or terminate your compensation benefits. The logic behind this policy is straightforward: if you’re medically cleared to perform available work but choose not to, you’re voluntarily limiting your income rather than being prevented from working by your condition.

This creates a delicate situation. You must carefully evaluate whether the offered position truly accommodates your restrictions and whether your physician agrees that you can safely perform the duties. If the light duty assignment exceeds your medical limitations, you should document this with your treating physician and communicate it to both USPS and OWCP.

The Medical Documentation Factor

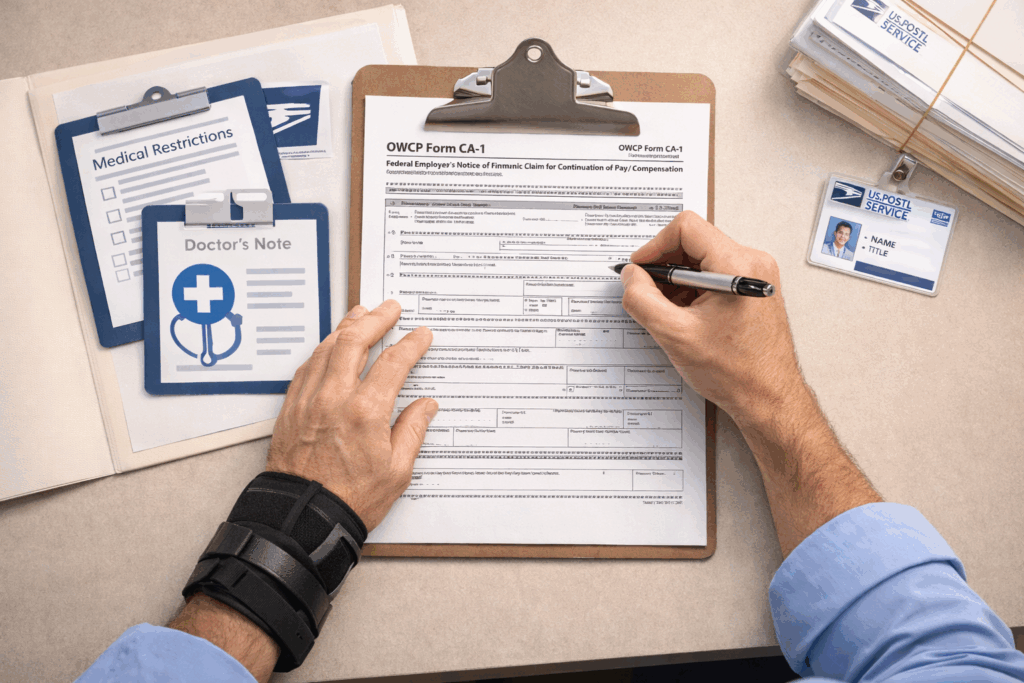

Your treating physician plays a central role in determining how light duty affects your benefits. When USPS offers you a modified assignment, they typically provide a job description to your doctor for review. Your physician must evaluate whether the duties listed fall within your current capabilities.

If your doctor approves the light duty assignment by completing the appropriate forms, USPS considers you medically cleared for that work. At this point, refusing the position could jeopardize your OWCP benefits. Conversely, if your physician determines that even the light duty tasks exceed your restrictions, you should obtain written documentation of this determination.

OWCP relies heavily on medical evidence when making decisions about your compensation. Detailed notes from your doctor explaining why you cannot perform specific duties carry significant weight. Vague statements about being “unable to work” are less effective than precise descriptions of your functional limitations.

How Light Duty Affects Your USPS Salary

When you accept a light duty position, your pay situation depends on several factors, including whether your condition is work-related and whether you’re receiving OWCP benefits.

If you’re working light duty while on an approved OWCP claim, you typically receive your actual wages for the hours worked. If the light duty position pays less than your regular position, OWCP may pay you compensation for the difference in wages. This is known as loss of wage-earning capacity benefits.

For example, if your regular position as a mail processing clerk pays you $50,000 annually, but your light duty assignment only pays $35,000, OWCP would compensate you for a portion of that $15,000 difference, based on the standard compensation rate.

However, if you’re working light duty for a non-work-related condition, you simply receive the wages for your light duty position without any OWCP supplementation, since workers’ compensation doesn’t cover non-occupational injuries or illnesses.

Limited Duty as a Long-Term Solution

While light duty serves as a temporary bridge during recovery, limited duty assignments can become more permanent arrangements when an injury or condition results in lasting restrictions. USPS may create or modify positions to accommodate employees who cannot return to their previous duties but can perform other productive work.

For employees with permanent or long-term restrictions, limited duty presents both opportunities and challenges. On one hand, it allows you to remain employed and maintain income, health insurance, and retirement benefits. On the other hand, if the limited duty position pays substantially less than your former position, you face a permanent reduction in earnings.

This is where understanding your disability coverage options becomes crucial. While OWCP may provide some compensation for lost wage-earning capacity, private disability insurance policies can help fill income gaps that workers’ compensation doesn’t fully address.

Impact on Private Disability Insurance

If you carry private disability insurance, either through a group policy or an individual plan, working light duty or limited duty affects your benefits differently than it affects OWCP compensation.

Most disability insurance policies define disability as the inability to perform the substantial and material duties of your own occupation. Some policies transition to an “any occupation” definition after a specified period, typically two years.

When you return to work in a light duty capacity, even with reduced earnings, many insurers will consider you partially disabled rather than totally disabled. Partial disability benefits typically pay a percentage of your income loss rather than your full disability benefit.

The specific impact depends on your policy’s provisions. Some policies include “residual disability” or “partial disability” riders that provide proportional benefits when you can work but earn less due to your condition. Others may reduce benefits dollar-for-dollar based on your earnings, while some use formulas that allow you to retain more of your disability benefit while working reduced hours.

It’s essential to review your policy documents and contact your insurer before accepting light duty to understand exactly how your benefits will be affected. In some cases, the combination of reduced wages plus partial disability benefits may exceed what you would receive from full disability benefits alone, making light duty financially advantageous.

When Light Duty Becomes Problematic

Not all light duty situations work out as intended. Some employees find that their assigned duties exceed their restrictions despite initial approval, leading to reinjury or worsening of their condition. Others discover that the light duty position is being used as a form of discipline or to pressure them into resigning.

If you experience either situation, document everything carefully. Keep copies of all medical restrictions, job descriptions, and communications with supervisors. If you believe your light duty assignment violates your restrictions, notify your supervisor in writing and request a review of the duties. Simultaneously, inform your treating physician about any tasks causing problems and request updated restrictions if needed.

You should also report any issues to OWCP, as they have oversight authority over how USPS handles injured workers. If you’re working light duty under an OWCP claim, the Department of Labor has an interest in ensuring your assignments truly accommodate your medical limitations.

The Rehabilitation and Return-to-Work Process

OWCP encourages injured workers to return to work as soon as medically feasible, viewing employment as beneficial for both physical and psychological recovery. The agency may offer vocational rehabilitation services to help you develop new skills if you cannot return to your former position.

Light duty and limited duty assignments often serve as steps in this return-to-work continuum. Ideally, these modified assignments allow you to gradually increase your work capacity while your condition improves. However, when injuries result in permanent limitations, limited duty may become your permanent work situation.

Throughout this process, maintaining open communication with all parties—your supervisors, your physician, and OWCP—helps ensure that decisions are made based on accurate information about your capabilities and limitations.

Making Informed Decisions About Light Duty

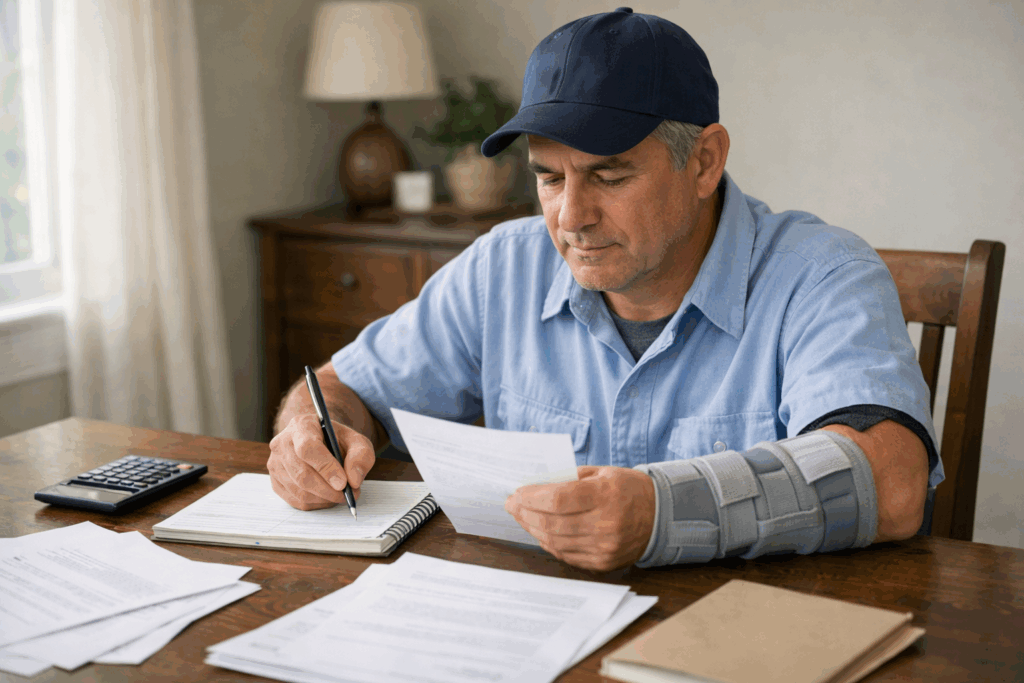

When USPS offers you a light duty assignment, you face an important decision that affects your immediate income, your long-term disability benefits, and your career trajectory. Several factors should inform your choice.

First, obtain a clear understanding of the job duties and compare them carefully against your medical restrictions. If anything seems questionable, discuss it with your physician before accepting.

Second, calculate the financial impact of accepting versus declining the assignment. Consider your regular wages, the light duty wages, potential OWCP compensation, and any private disability insurance benefits. Sometimes the numbers clearly favor one option.

Third, consider the long-term implications. Will accepting light duty position you for eventual return to your regular duties, or will it become a permanent assignment at lower pay? Does the position offer opportunities for advancement, or does it represent a career dead end?

Finally, understand your rights. You’re not required to accept light duty that exceeds your medical restrictions, and you shouldn’t face retaliation for declining assignments your doctor has not approved. However, you may face benefit reductions if you refuse suitable work without valid medical justification.

Protecting Your Income During Recovery

When a USPS employee is injured or becomes ill, navigating light duty assignments, OWCP benefits, and other income protection options can be confusing. Each program follows different rules and calculates benefits differently, so misunderstanding them can lead to unfavorable decisions.

The most important step is understanding how these benefits work together before accepting light duty or making statements about your work capacity. Decisions should be based on medical evidence and actual functional ability—not financial pressure or confusion about the system.

If you are experiencing income loss due to a work-related injury, understanding your disability income protection options can help provide stability during recovery.

To better understand how Continuation of Pay and OWCP benefits work together, read our guide: USPS Continuation of Pay (COP) vs OWCP — What’s the difference?