If you’re a postal employee with an injury or illness that prevents you from working, you can no longer earn an income. This can put you at risk of being unable to pay your bills, such as credit card payments, mortgage payments, groceries, utility bills, transportation, and so on.

Unfortunately, most families live paycheck to paycheck. And many find it hard to imagine such a predicament, but it’s a reality worth considering. If an injury or illness occurs, disability insurance for postal employees can offer some protection.

Disability insurance can help replace a significant portion of your income when you cannot work because of an illness or temporary or permanent disability.

Why Postal Workers Need Disability Insurance

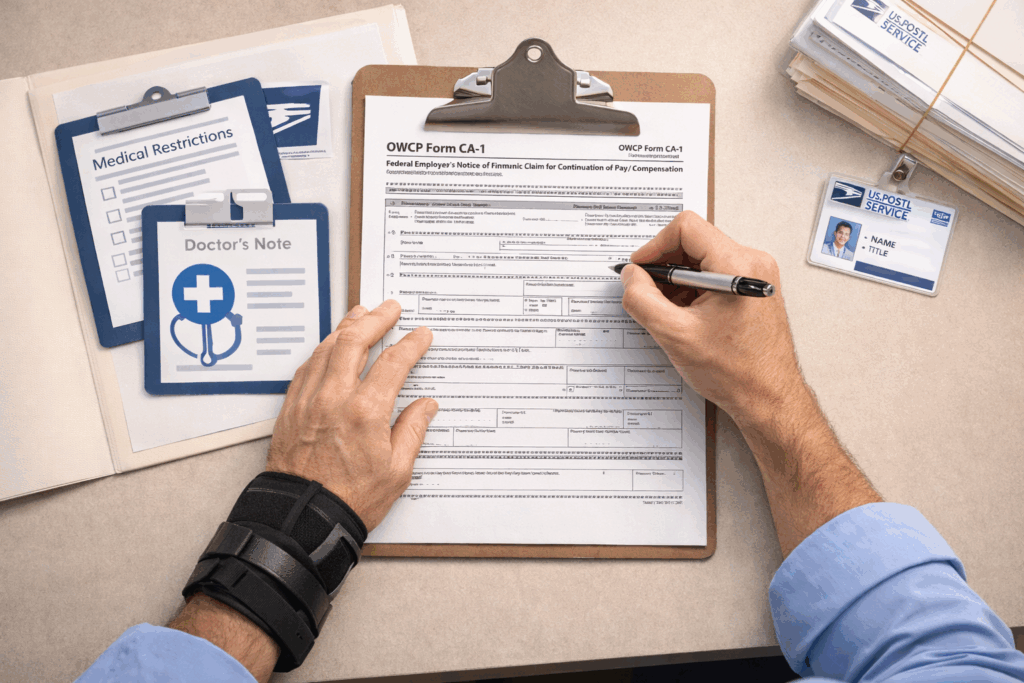

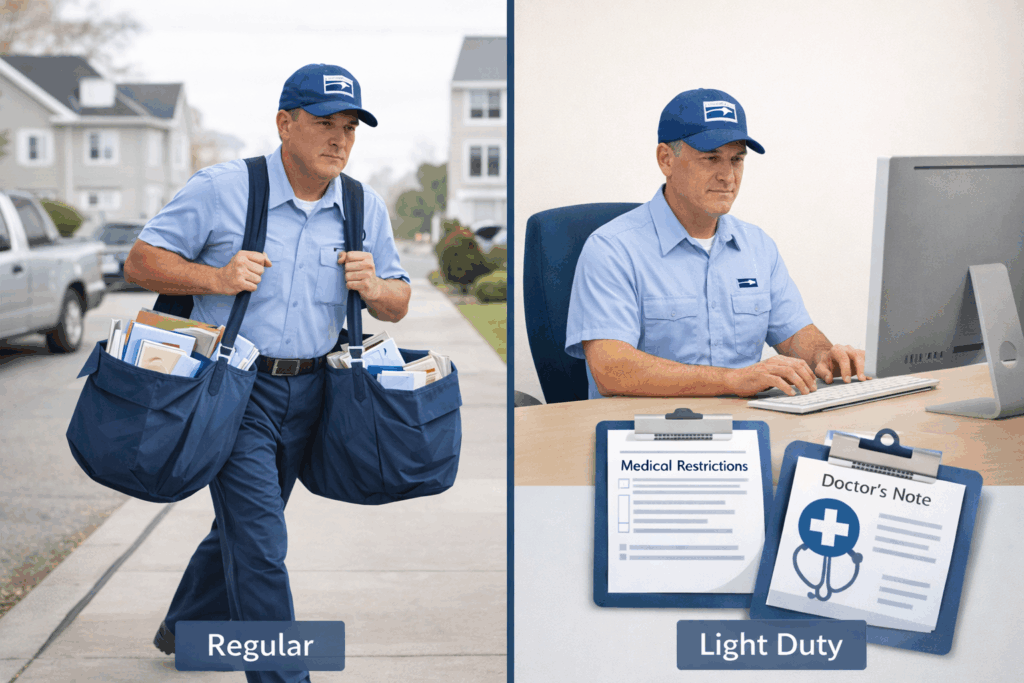

Postal workers often find themselves in physically demanding and hazardous situations. Heavy packages, cluttered walkways, dangerous drivers, and aggressive dogs are just some of the daily hazards that postal service workers encounter.

Those in post offices and sorting rooms may also suffer work-related injuries due to repetitive movements.

The United States Postal Service protects its employees through leave and disability retirement. While these programs may seem like they provide sufficient protection, they are separate plans that may not always work together. Qualifying for one doesn’t necessarily mean you qualify for the other.

If you’re a postal worker, first learn about your current coverage to ensure you feel comfortable with what it offers.

It helps to note that the federal government doesn’t provide short-term disability insurance for postal employees, federal employees, or federal service workers. However, postal workers can choose coverage options for supplemental insurance provided they acquire them before injury or missed work because of illness.

At Postal Life and Disability Plans, we offer short-term disability insurance options for postal employees. We work with a reputable company that is over 150 years and covers over 100,000 postal employees.

Benefits of Short-Term Disability Insurance

Short-term disability insurance coverage typically starts paying disability benefits within two weeks of a qualifying injury or illness. You’ll keep receiving benefits until you can resume work or until the benefit period expires.

Short-term disability insurance provides much-needed peace of mind and offers financial stability for you and your family until you get back on your feet.

Our Short-term Disability Program

We offer our short-term disability program as a group plan only to postal employees who meet a few simple conditions regarding their work status. You don’t have to pay higher premiums for your age, sex, or physical condition. Simply pick the benefit amount and pay a flat rate based on the monthly benefit.

Our program benefits include the following:

- Monthly benefits of up to $2,000/month tax-free payable for up to one year per occurrence

- No physicals or examinations

- Payroll deduction for premiums

- Covers both on and off-the-job injuries

- Your doctor decides whether you can work or not

Are you ready to sign up for our disability insurance for postal employees’ coverage? It’s a straightforward process.

Choose your benefit level and waiting period. Then make your application. That’s it. Contact us today!