As a USPS employee, your job plays a vital role in keeping America connected. But what happens when an injury or illness prevents you from performing your duties? That’s where postal disability insurance becomes a crucial safety net.

In this guide, we’ll explain what postal disability coverage is, why it matters, what your options are, and how to get started with a plan tailored specifically for postal workers.

What Is Postal Disability Insurance?

Postal disability insurance is a form of income protection designed to help USPS employees manage financially if they become temporarily or permanently unable to work due to a medical condition.

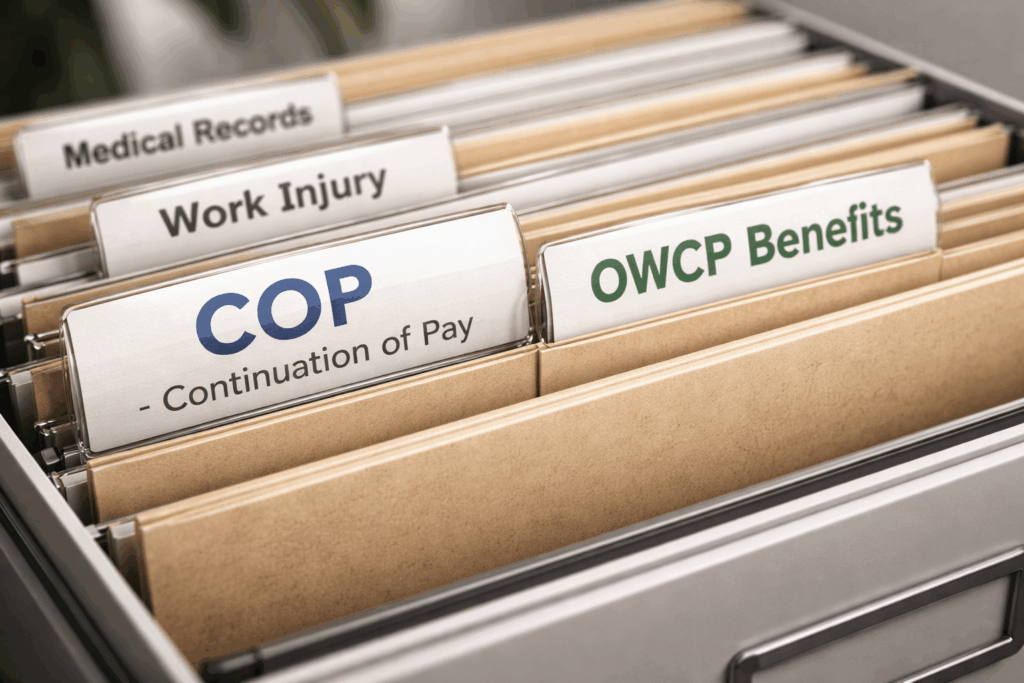

There are two main types:

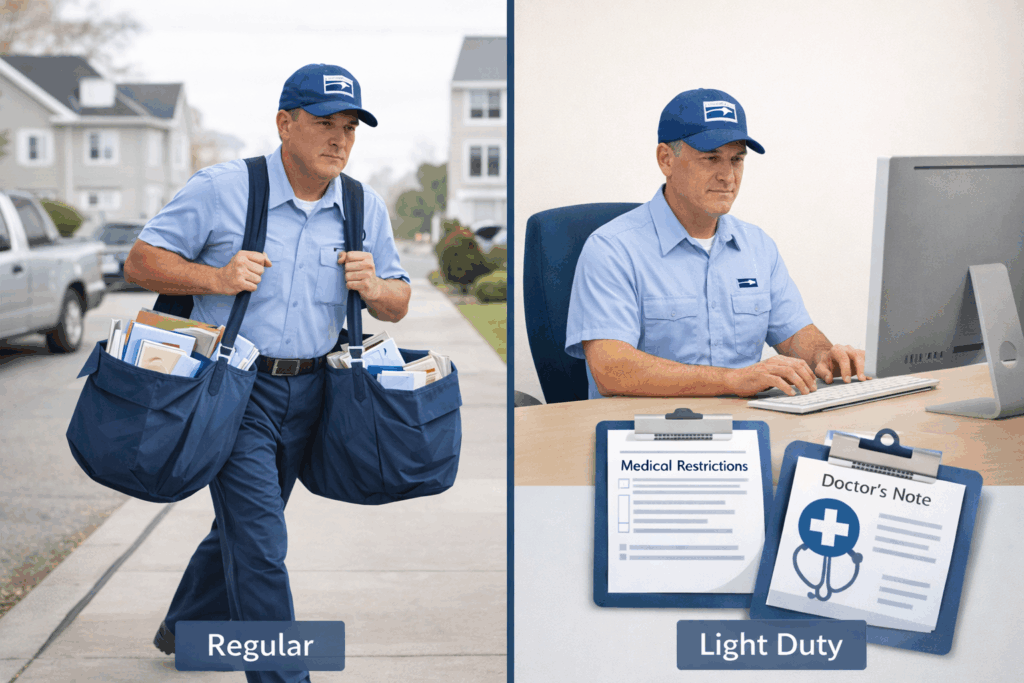

- Short-term disability: Covers temporary injuries or illnesses, typically providing benefits for a few weeks to several months.

- Long-term disability: Offers coverage for more serious or long-lasting medical conditions that extend beyond the short-term benefit period.

Why USPS Employees Need Disability Coverage

While the federal government offers some benefits, they may not be enough to fully protect your income during extended absences. That’s why many postal employees choose supplemental coverage from private providers.

Here’s why you should consider postal disability insurance:

- Protect your income if you’re unable to work

- Reduce financial stress during recovery or treatment

- Supplement limited government benefits or accrued sick leave

- Cover living expenses, medical bills, and other obligations

Who Is Eligible for Postal Disability Insurance?

Most career and non-career USPS employees can qualify for disability coverage. Eligibility may depend on factors such as:

- Job classification (career, transitional, etc.)

- Length of service

- Enrollment period

- Health status at the time of application

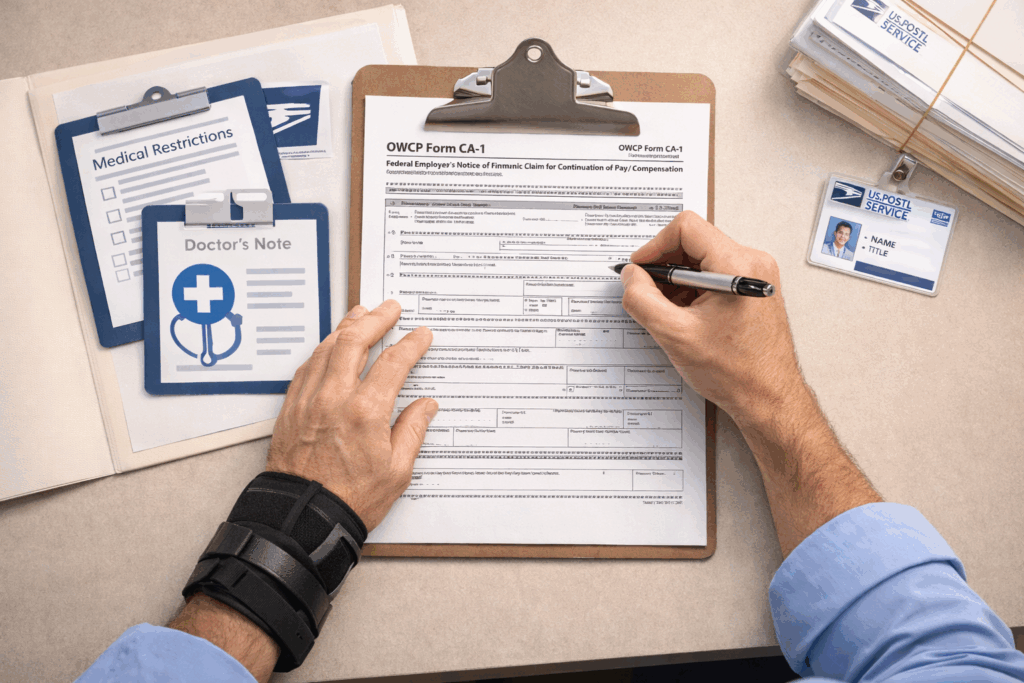

How to Get Disability Coverage as a USPS Employee

At Postal Life and Disability Plans, we specialize in disability insurance for postal workers, offering customized plans that provide peace of mind and practical protection.

Here’s how to get started:

- Review your options for short-term and long-term coverage

- Compare benefit amounts and waiting periods

- Enroll online or reach out to our team for assistance

We offer:

- Fast online enrollment

- Plans tailored for USPS employees

- Competitive premiums

Common Conditions That May Qualify

Disability claims can be approved for a wide range of conditions, including:

- Back injuries

- Surgery recovery

- Mental health conditions

- Chronic illnesses

- Pregnancy and maternity leave complications

As long as the condition prevents you from working and is verified by a healthcare provider, you may be eligible for benefits.

Final Thoughts

Whether you’re dealing with an unexpected injury or planning for future protection, having a solid postal disability insurance plan can make all the difference. Don’t wait until it’s too late to secure the coverage you deserve.